Reporting | August 3, 2012 | 3 min read

New Tax Merge Codes in Templates

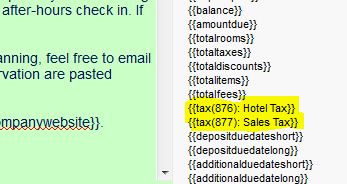

Added new codes to email templates – for total amounts paid of each tax category. The format for the new codes is like this: {{tax(876): Hotel Tax}}{{tax(877): Sales Tax}}

Added new codes to email templates – for total amounts paid of each tax category. The format for the new codes is like this:

{{tax(876): Hotel Tax}} {{tax(877): Sales Tax}}

ReservationKey, a leading property management software, has rolled out a significant feature enhancement—new tax merge codes for templates. This update is designed to make tax presentation more accurate and dynamic, helping property managers offer guests clearer booking details and comply better with local tax laws.

Introduction to Merge Codes in ReservationKey

Merge codes are small snippets like \{guest_name\} or \{arrival_date\} used in template messages. These codes automatically pull specific booking data into emails, invoices, and other guest communications. They’re essential tools in automating personalized interactions, ensuring accuracy and saving time.

Templates, on the other hand, are pre-set messages you send to guests—confirmation emails, invoice summaries, reminder notices, and more. With the new tax merge codes, these templates now become even more powerful and legally compliant.

Request A Demo For Each And Every Steps.

Why This Update Matters Now

Managing taxes across bookings has always been complex—especially with regional variations. Many users requested a way to clearly itemize and communicate taxes in guest-facing messages. This update is ReservationKey's response.

In some regions, regulations now require clearer invoice breakdowns. The new tax merge codes help you comply, reduce errors, and communicate charges more transparently.

What’s New in the Tax Merge Code Update

Some of the newly introduced codes include:

\{tax_total\}– Total tax amount applied\{tax1_amount\}– Individual tax line 1\{tax2_amount\}– Individual tax line 2\{tax_description\}– Description of each tax type

These codes allow template fields to populate dynamically based on each reservation's tax setup, ensuring real-time accuracy without manual editing.

How to Implement Tax Merge Codes in Your Templates

Follow these steps:

- Navigate to Settings > Templates

- Select the template type (e.g., invoice email)

- Insert new tax merge codes where appropriate

- Save and preview your template to ensure proper formatting

Recommended templates to update:

- Booking confirmation emails

- Final invoice or balance due notices

- Reminder messages showing breakdowns

Benefits for Property Managers

- Accuracy – Automatically show the correct tax amount, no matter the location or booking type.

- Transparency – Guests see exactly what they’re being charged for.

- Time-saving – Set it once, and the system does the rest.

- Legal Protection – Stronger compliance with state or country regulations.

Examples of Updated Templates

Before:

"Your total is $230. Taxes included."

After:

"Your total is $230. This includes tax of {tax_total}."

Before: Manual editing required for every tax change. After: Dynamic updates ensure correct tax is always shown.

Impact on Guest Communication

Clearer pricing builds trust. When guests receive a breakdown that includes specific tax amounts and labels, it eliminates surprises and reduces complaints. This upgrade contributes to a more professional image.

Compatibility with ReservationKey Features

These tax merge codes are compatible with:

- Email templates

- Printable invoices

- Guest reminders

- Confirmation summaries

They function seamlessly with the booking summary screen, ensuring full-circle accuracy.