Reporting | August 21, 2012 | 3 min read

New Option to Include Tax on Percentage Items for Sale

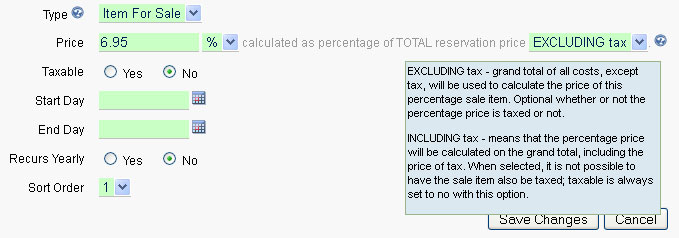

Now you can set whether or not an item for sale that is a percentage should calculate the percentage price based on the total reservation price, including or excluding tax. This is useful if you are selling something such as Trip Insurance, that needs to be based on the total price of the entire reservation, …

Now you can set whether or not an item for sale that is a percentage should calculate the percentage price based on the total reservation price, including or excluding tax. This is useful if you are selling something such as Trip Insurance, that needs to be based on the total price of the entire reservation, including tax.

Section for making this selection:

Why This Matters

If you've ever offered percentage-based items—such as insurance, service fees, or add-ons—Revenue calculations could get messy.

Previously, the system automatically based percentage items only on pre-tax reservation totals, which sometimes led to under-collecting or inaccuracies. This new choice empowers you to include tax on those percentages, so everything's calculated correctly from the start quickbooks.intuit.com

What Changed?

- New checkbox setting: You can now decide whether a percentage‑based item calculates from the tax‑included or tax‑excluded total.

- Use case example: Trip Insurance (say 5%) can be based on the reservation total – even if that total already includes room tax .

- Retroactive accuracy: If your local law requires percentage‑add‑ons to calculate on tax-inclusive totals, this fix ensures compliance.

How to Configure This

- Go to Items for Sale → Edit a percentage‑type item.

- When enabled, a checkbox labeled something like “Calculate based on tax‑included total” appears.

- Toggle it on and your percentage will now consider the total reservation cost plus tax.

- Save—and your pricing logic just got more accurate help.myintervals.com

Free Trial

Benefits at a Glance

BenefitExplanationAccuracyCharges reflect full totals, avoiding under‑ or over‑charging feesCompliance-readyAligns with tax rules for services/add‑ons in many jurisdictionsFlexibilityFine‑tune transparency: show or hide tax breakdown per your preferenceImproved guest trustClearer billing can reduce misunderstandings and boost satisfaction

What It Means for You

- If you're mandatory to include tax on insurance or service fees, just toggle the option on to stay compliant.

- If you prefer simplicity, leave it off—but know you may want to clarify that percentages are off tax.

- If you're operating multi-jurisdiction, double-check the tax setting per region to stay ahead.

Pro Tip: Pair with Other Tax Controls

ReservationKey already lets you:

- Tie specific taxes to rate plans or individual fees/items cpajournal.com.

- Split tax rates (e.g., part flat fee, part percentage) .

- Include VAT in prices but hide it on the guest-facing end .

This new addition slots into those existing capabilities to give you a high-powered, fully customizable tax setup.

🎬 Real-World Scenario

Let’s say:

- Base room rate: $200

- Room tax: 10% → $20

- Trip insurance: 5%

Before this update: Trip insurance charged at 5% of $200 = $10 (not including the $20 tax). With the update on: It’s now 5% of $220 = $11 → more precise and compliant.

Your guests might not notice the extra $1, but it adds up—automatically and accurately—to your revenue.

Wrapping Up

ReservationKey’s rollout of this new feature gives you:

- Greater control over fee calculation

- Stronger accuracy in final charges

- Easier compliance with tax regulations

All told, just another smart step toward seamless, transparent bookings.

Let me know if you'd like a walk‑through of your exact setup—or want help enabling this in your account.